Worrying about tax problems keeping you up at night? You’ve got company, even when it feels like you’re solo. Annual tax season dread affects millions of Americans, be it mismatched math or tangled audits. Breathe easy – we’ve got a treasure trove of valuable insights and actionable strategies to see you through these tough spots.

Whether you’re dealing with a tax lien, a CP14 notice, or just confused about the tax code changes, tax issues can feel overwhelming. Knowledge is power when paying taxes. Want to skip the stress and dread of tax season? Pick up the skills and know-how to master your tax return, crunch the numbers with confidence, and breathe easy come tax time.

Table of Contents:

- Understanding Common Tax Issues

- Navigating the 2025 Tax Cliff

- Addressing Tax Issues: Resources and Strategies

- Conclusion

Understanding Common Tax Issues

Tax issues vary and impact both individuals and businesses. You’re probably wondering about those pesky tax issues – like getting stuck with a whopping bill or dealing with the IRS over a disputed payment. It is advisable to address these issues proactively.

- Unpaid Tax Bills: Receiving a CP14 notice from the IRS regarding an outstanding balance can be alarming. Contact the IRS using the number on your notice to discuss payment options or establish a payment plan.

- Tax Liens: A federal tax lien is the government’s claim against your property for unpaid tax debt. Don’t tackle this tough spot alone – we’re here to lend a hand. Brush up on federal tax liens and get ready to tackle one of the most taxing financial woes out there. Get personalized support by calling 1-800-913-6050 – we’ll walk you through it step by step.

- Tax Disputes: If the IRS and you can’t see eye-to-eye on your taxes, know that you’ve got backup. Organizations are standing by to lend a hand. The Taxpayer Advocate Service and Low Income Taxpayer Clinics provide free or low-cost help with tax return issues. The IRS Independent Office of Appeals helps resolve disputes outside of court; determine if it suits your needs .

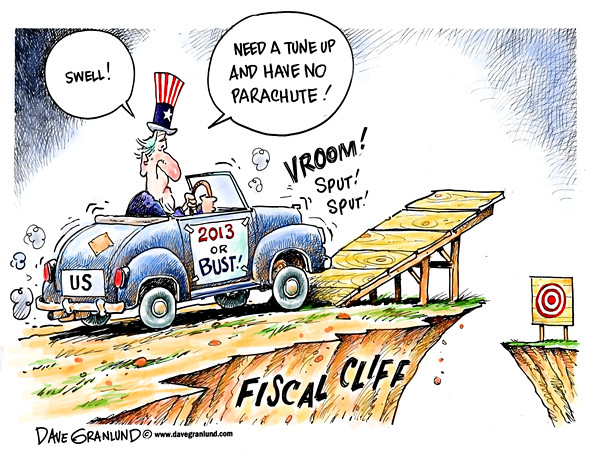

Navigating the 2025 Tax Cliff

The 2025 “tax cliff” involves the expiration of several 2017 Tax Cuts and Jobs Act (TCJA) provisions. As taxpayers contend with personal, business, and international tax obligations, one thing is clear: it sparks concerns far and wide.

Here’s a breakdown of what’s at stake for the tax year:

- Corporate Tax Rates: Potential increases to the 21% corporate tax rate are being discussed, concerning business leaders and policymakers. If this comes to pass, small businesses and farm income could be slashing their budgets – and that’s a scary thought.

- Individual Tax Cuts: Deductions, credits, and the child tax credit from 2017 might expire. You can’t assume a one-size-fits-all outcome; the impacts would clearly depend on income brackets. The earned income tax credit is another concern. Imagine a tax code that favors the everyday worker over fat-cat corporations and the ultrarich – that’s what Democrats are pushing for, with plans to give lower- and middle-class families a helping hand while making the wealthy chip in more. One potential revenue source is increasing estate taxes by reducing the exemption.

- International Taxes: Changes to international tax rules, like Global Intangible Low-Taxed Income (GILTI), take effect in 2025. Businesses that operate across borders will likely feel the pinch of this development.

Preparing for the Tax Cliff

Given the uncertainty, advanced planning is recommended. Here’s how to get started and maximize your tax benefits:

- Stay Informed: Stay up-to-date on tax law. For the latest policy scoop, take a cue from the IRS itself. Always be looking out for the next wave of changes so you can ride it out successfully. You can use their advanced search option to locate relevant content and find answers to frequently asked questions. Consider how the Trump administration legislative changes affected tax expenditures. Get up to speed on the intricate web of international tax rules and regulations. What happened when Pakistan’s Finance Minister sat down with the Federal Board of Revenue? The air was cleared and disputes on taxes began to dissolve as talks got underway.

- Consult Professionals: Consult financial advisors or tax professionals. Situations change, but with their guidance, you’ll stay on track. Explore tax deductions, investment adjustments, and other tax credits you may be able to benefit from when filing your federal tax return. Prepare for 2025, as entrepreneurs already are concerning 2025 economic challenges.

- Review Finances: Analyze your current financial status, cash flow, and investments. Plan ahead: what will your bank account look like in 2025? Build a clear financial roadmap for the next two years using these projections as your guide. Pinpoint the trouble spots that require a refresh. Assess your current compliance with tax rules to prevent future tax issues.

Addressing Tax Issues: Resources and Strategies

This section lists key government services and private organizations offering support and resources related to tax benefits and how to pay taxes less.

Government Agencies

| Agency | Focus | Website |

|---|---|---|

| Internal Revenue Service (IRS) | Tax collection, enforcement, and education | irs.gov |

| Taxpayer Advocate Service (TAS) | Resolving taxpayer issues with the IRS | taxpayeradvocate.irs.gov |

| U.S. Department of the Treasury | Manages federal finances, including tax policy | home.treasury.gov |

Private Organizations

Low Income Taxpayer Clinics (LITCs) offer specialized support throughout the US. LITCs provide free or low-cost assistance, including representation during disputes, to those who qualify. They’re here to empower taxpayers – farm households, too – with a clear understanding of their tax roles and responsibilities. If eligible, utilize an LITC for assistance with your tax issues. The dependent care credit is often something LITC’s assist with.

The finish line is in sight – let’s pinpoint the key takeaways.

Tax season rolls around, and suddenly you’re forced to wrangle a slew of forms, figures, and regulations – no wonder it’s a source of major stress. Get a grip on problems by having a solid plan and staying informed – it makes all the difference. Take the next step with the practical guidance and expert insights found in this guide. Maximizing your savings requires staying in the loop. Don’t let financial surprises catch you off guard – make it a habit to track tax rates, inflation reduction plans, and other important financial metrics to stay in control of your money.

Whether you’re tackling an audit or just navigating the tax landscape, knowing the laws and having the right resources makes all the difference. Financial stability starts with a solid grasp of taxes – that means wrapping your head around the child tax credit, capital gains tax, and standard deduction, and using that knowledge to your advantage. Be prepared for 2025.