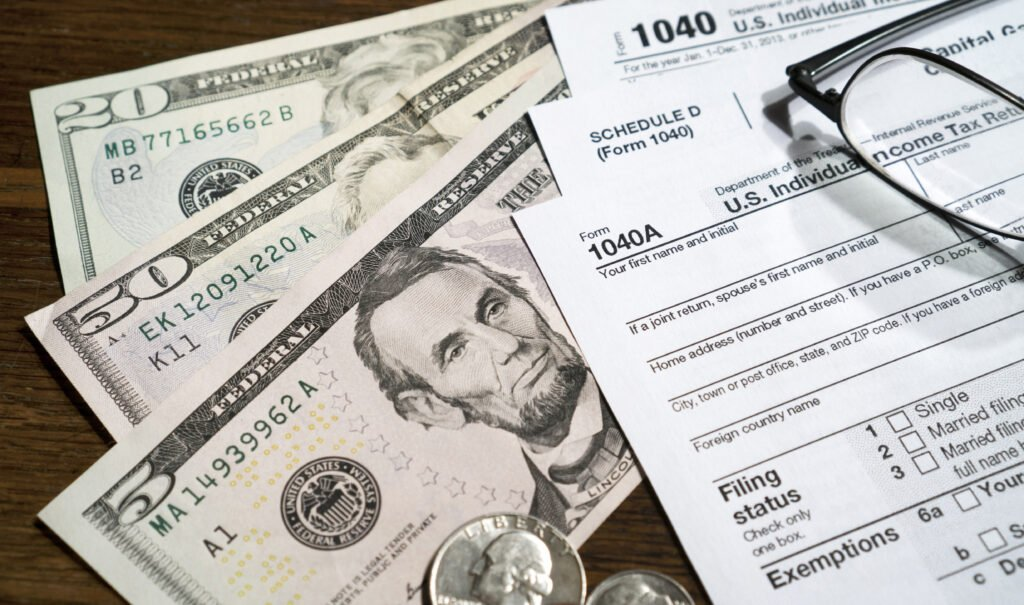

Forget to file, and you’ll be slapped with penalties; make a mistake, and you’ll lose hard-earned cash – that’s why getting taxes right is vital! Honestly, there’s something to be said still about hiring an accountant….

But the fact is understanding business tax basics can feel a bit overwhelming even if you’re hiring someone to do it, or you’ve even recruited an HR department to manage it. Especially when starting out your business. Can’t blame you on that! But listen up…. Start-up founders, small business owners, and entrepreneurs – thankfully, this guide’s got you covered when it comes to grasping the essentials of business taxes, from start to finish.

Don’t let tax season stress you out – our resources and insights will give you the know-how to handle your taxes like a pro.

Table of Contents:

- Getting Started with Business Tax Basics

- Understanding Different Business Taxes

- Tips for Managing Business Tax Basics

- Deductions and Business Tax Basics

- Conclusion

Getting Started with Business Tax Basics

First, you might need an Employer Identification Number (EIN), which is like a Social Security number for your business. The IRS is watching: they use this to monitor your tax payments.

You can apply for an EIN online through the IRS website.

Do You Need an EIN?

Not every business needs an EIN. Corporations, partnerships, and some sole proprietorships do.

You also need one if you hire employees or operate your business under a name besides your legal name. Facing the mountain of tax requirements for your new business? First, secure an EIN – it’s a vital identifier for your company that sets you up for tax compliance.

Understanding Different Business Taxes

Let’s explore the different business taxes. Businesses usually fit into a few distinct groups.

Income Tax

Like individuals, almost all businesses (excluding partnerships) file an annual income tax return. You’ll pay income tax as you earn or receive income.

As a self-employed individual, your tax burden includes funding your own Social Security and Medicare benefits – don’t forget to set aside those hard-earned dollars! This often involves paying estimated taxes quarterly.

Partnerships file an informational return (Form 1065). Each partner claims their share of income or loss on their own tax return. Your business legal structure can affect how much you pay in taxes. Because of this, companies must adjust their tax strategy, and submitting an income tax return becomes a requirement.

Employment Taxes

If you have employees, you must handle employment tax responsibilities. This includes withholding federal income tax, Social Security, and Medicare taxes (both your share and your employees’ share). You’ll also pay federal unemployment (FUTA) tax.

A payroll service provider can help track and file these taxes. Take a weight off your shoulders – this setup makes quick work of payroll tax duties, guaranteeing you’re in compliance.

State and Local Taxes

Beyond federal taxes, businesses face state and local tax obligations. The taxman cometh, and he’s got three hats: income, sales, and unemployment.

Got a new business venture? Don’t forget to check in with your state about taxes! Income tax, sales tax, and unemployment tax rules vary from state to state, so do your research to avoid any hang-ups. Operating your business a certain way can put you in line for some juicy incentives in some states.

Sales Taxes

Selling goods or certain services usually requires collecting and remitting sales taxes. These rules vary widely by state and even local jurisdictions.

Consult your state’s Department of Revenue or similar taxing authorities for guidance on your business federal tax identification responsibilities and social security and medicare taxes generally. Whether you’re flying solo or running a female-led venture, state agencies offer tax resources that can help you thrive.

Excise Taxes

Some businesses must pay excise taxes on specific goods, services, or activities. We’re talking about basics like gas for your car, cigarettes, and flights – these are just a few examples.

Don’t let excise taxes sneak up on you – make a pit stop at the IRS website to confirm whether your business owes. Fulfilling business payroll tax responsibilities can get pretty sticky, especially when dealing with products that carry an excise tax.

Tips for Managing Business Tax Basics

Taxes can be complex. Separating business and personal finances helps with organization and tax preparation. Use dedicated business bank accounts and credit cards.

Stay on top of tax deadlines to sidestep those pesky fines. Tax laws change frequently, so stay updated or consult a tax professional for guidance. With their expert guidance, you’ll get advice that’s perfectly aligned with your W-2 requirements.

Staying on top of tax laws means avoiding costly penalties and accurately handling income tax withholdings – it’s a crucial part of responsible financial management. Quarterly tax payments can be part of effective tax payment strategies. Consider hiring independent contractors or other ways of business operation as this impacts taxes generally. The tax landscape looks vastly different depending on the type of business you’re running.

Deductions and Business Tax Basics

Deductions reduce your taxable income, lowering your tax bill. Common deductions include office expenses, travel, marketing costs, and insurance premiums. Maintain organized financial records for these expenses.

Properly claiming deductions involves tracking business income and expenses. Net income is determined after deductions. Accurate record-keeping helps in case of an IRS audit. Be sure to track pay tax payments made throughout the year.

If your annual profits are less than $400, you don’t need to file taxes. Ensure you have an accurate understanding of self-employed tax requirements. Understand the differences between employee taxes withheld versus your responsibilities as a sole proprietor. Consider any tax credits you may be eligible for. You may be required to issue 1099-NEC forms if you paid any independent contractors more than $600 for their services during the year.

And that brings us to the end of the road – where our exploration reaches its finale and we recap the essentials.

Business owners who fail to grasp tax basics are playing with fire – it’s a crucial aspect of running a profitable venture. Gain control of your finances and stop stressing about taxes by following these simple steps. Stay current on payroll taxes and federal tax identification numbers to keep your business running smoothly and staying ahead of the game. Keep in mind the intricacies of Social Security and Medicare tax, along with self-employment taxes and other business tax basics for your sole proprietorship or small business.